crypto tax calculator canada

Powerful Accurate Tax Reports. Koinly is compatible with Canadas tax laws and regulations and if you have a paid plan you can print tax reports including an income report capital gains report and a buysell report.

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare

Canada Pooling with same-day and 30-day rules United Kingdom Spot pricing for more than 20000 trading pairs.

. Lets say you bought Bitcoin at 42000 and sold it at 50000. Configurable tax settings Covers NFTs DeFi DEX trading Integrates major exchanges wallets and chains start free trial 500 integrations 100k users 150M transactions Overall gain 4700021 Income 85634 Short term 994544 Long term 3619843 ETH 313847 YFI 3849790 DOT 2121 46 transactions. This is the amount you are liable for on your short-term gains tax.

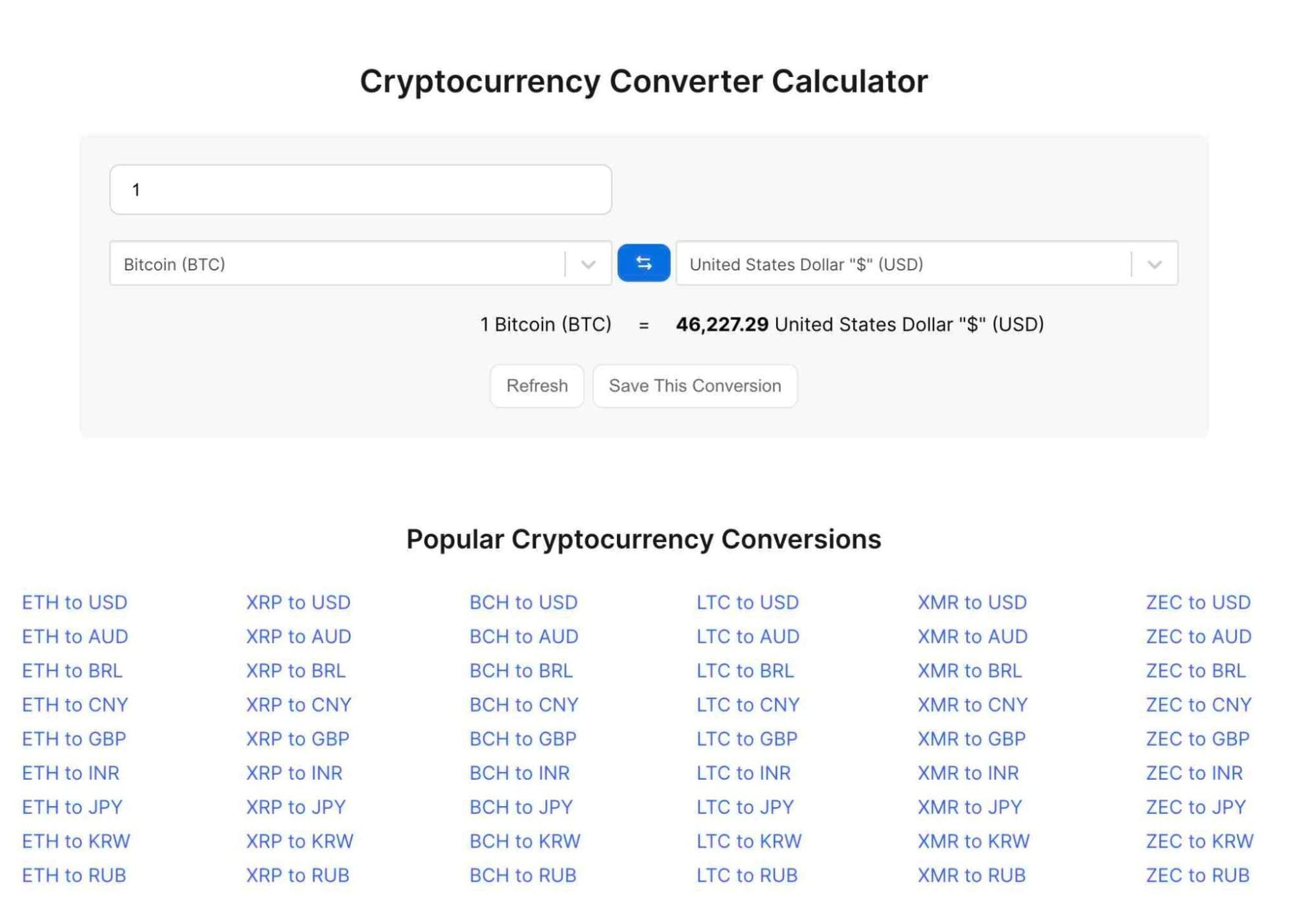

Sign In with Google. Is cryptocurrency taxable in Canada. A tool to calculate the capital gains of cryptocurrency assets for Canadian taxes.

Best crypto tax software for Canada Find the right crypto tax software to help do your crypto taxes in Canada. Sold LTC worth 12000 for 13000 after more than a year. Youll pay tax on your cryptocurrency profits in Canada.

Your cryptocurrency tax rate on federal taxes will be the same as your capital gains tax rate. Or Sign In with Email. Calculate your capital profits tax estimate with Finders free calculator.

Crypto Tax Calculator Plans Pricing Generate reports for all financial years under just the one 365-day subscription. Cryptocurrency isnt seen like a fiat currency in Canada. Similar to many countries cryptocurrency taxes are taxed in Canada as a commodity.

The rate you pay on crypto taxes depends on your taxable income level and how long you have held the crypto. Use a crypto tax calculator Tracking your cost basis across multiple exchanges and wallets as well as your subsequent capital gains and losses as well as any crypto income is. However it is important to note that only 50 of your capital gains are taxable.

Hobbyist CA 99 billed yearly Get started. The capital profits Tax CGT is calculated through first figuring out if there is a capital benefit thats calculated via With the entire market cap of the crypto zone dropping by means of a whopping 10 inside the previous few hours it appears. This is the amount you are liable for on your long-term gains tax.

Why do you need to know if its classed as a capital asset from a tax perspective. Crypto Tax Calculator Trader. You might be wondering how you report cryptocurrency taxes in Canada.

Any losses are treated as business losses or capital losses. All of Investor Features. The most common type of crypto tax is the capital gains tax.

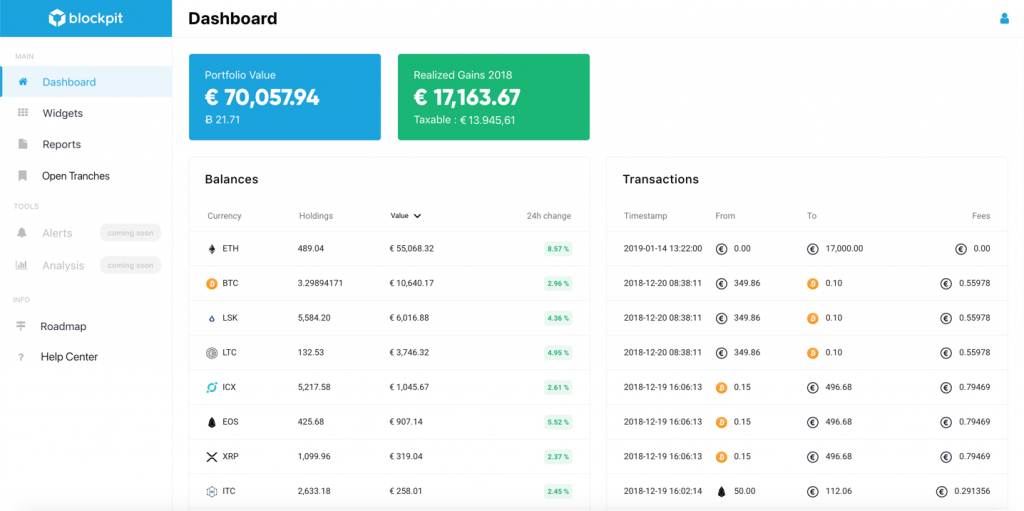

Crypto Tax Calculator. Crypto tax guide Mining staking income Generate complete tax reports for mining staking airdrops forks and other forms of income. Direct support for over 400 exchanges wallets DEXs and DeFi protocols.

Current proceeds are 13000. Use our Crypto Tax Calculator. Hobbyist 99 billed yearly Get started.

Instead its viewed as a commodity which is a capital property - like a stock or a rental property. The adjusted cost base ACB is used to calculate the capital gains. Koinly is a free-to-use crypto tax calculator that can help you file your crypto taxes in Canada.

If thats you the CRA will consider your crypto earnings as income not as capital gains says Hayward and tax you accordingly. As a refresher short-term capital gains had a rate of 10 to 37 in 2021 while long-term capital gains had a rate of 0 to 20. Bitcoin Tax Calculator for Canada Koinly is the only cryptocurrency tax calculator that is fully compliant with CRAs crypto guidance Schedule 3 Form Adjusted Cost Basis Superficial Loss Rule Start for free See our 500 reviews on Do you need to file crypto taxes.

And by that we mean at a higher rate. Our platform performs tax calculations with a high degree of accuracy. Rookie 49 billed yearly Get started For users who dabble in the crypto space.

Using Koinly to Report Crypto Taxes In Canada. There are lots of different ways of calculating this but the most common way is to find the price of your cryptocurrency at the time you bought it and compare the price at which you sold. Check out our free and comprehensive guide to crypto taxes.

Crypto Tax Calculator Plans Pricing Generate reports for all financial years under just the one 365-day subscription. It is calculated as follows. Profits are usually treated as business income or capital gains.

Personal Accountant Rookie CA 49 billed yearly Get started For users who dabble in the crypto space. Get started JOIN COINPANDA Sign up for free Calculate your taxes in under 20 minutes. Ideal for crypto enthusiasts or holders.

CryptoTaxCalculator CryptoTaxCalculator The most accurate crypto tax software solution for both investors and accountants. Get Started Complete free. Ideal for crypto enthusiasts or holders.

If for instance you earn 1000 through crypto trading and your tax rate is 25 youll end up with a tax bill of 125 on those funds or 25 of 500. Proceeds - Cost Basis 1000 Profit. Exchanges Blockchain Blockchain Main Wallets Supported Main Wallets Supported Core Features Tax-loss Harvesting Tool Crypto Portfolio Tracker TurboTax Integration Supports DeFi Supports NFT Capital Gains Report TaxAct Integration.

Simply copy the numbers into your annual tax return. A simple way to calculate this is to add up all your capital gains and then divide this by 2. 5600 capital gain taxed at 50 2800 taxable capital gain If on the other hand the original purchase price of the 25061 Bitcoins had originally been 25000 but at the time that Francis exchanged them for 100 units of Ethereum they were worth only 20600 he would have a capital loss.

The source data comes from a set of trade logs which are provided by the exchanges. You would pay capital gains tax on 50 of that profit. If you sell it for more than you bought it youll be liable for a capital gains tax.

9 Best Cryptocurrency Tax Calculator For Filling Crypto Tax 2021 Coinfunda

Cryptocurrency Tax Calculator The Turbotax Blog

Calculate Your Crypto Taxes With Ease Koinly

9 Best Cryptocurrency Tax Calculator For Filling Crypto Tax 2021 Coinfunda

Best Cryptocurrency Calculator Mining Profit Taxes

![]()

9 Best Cryptocurrency Tax Calculator For Filling Crypto Tax 2021 Coinfunda

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare

How To Calculate Crypto Taxes Koinly

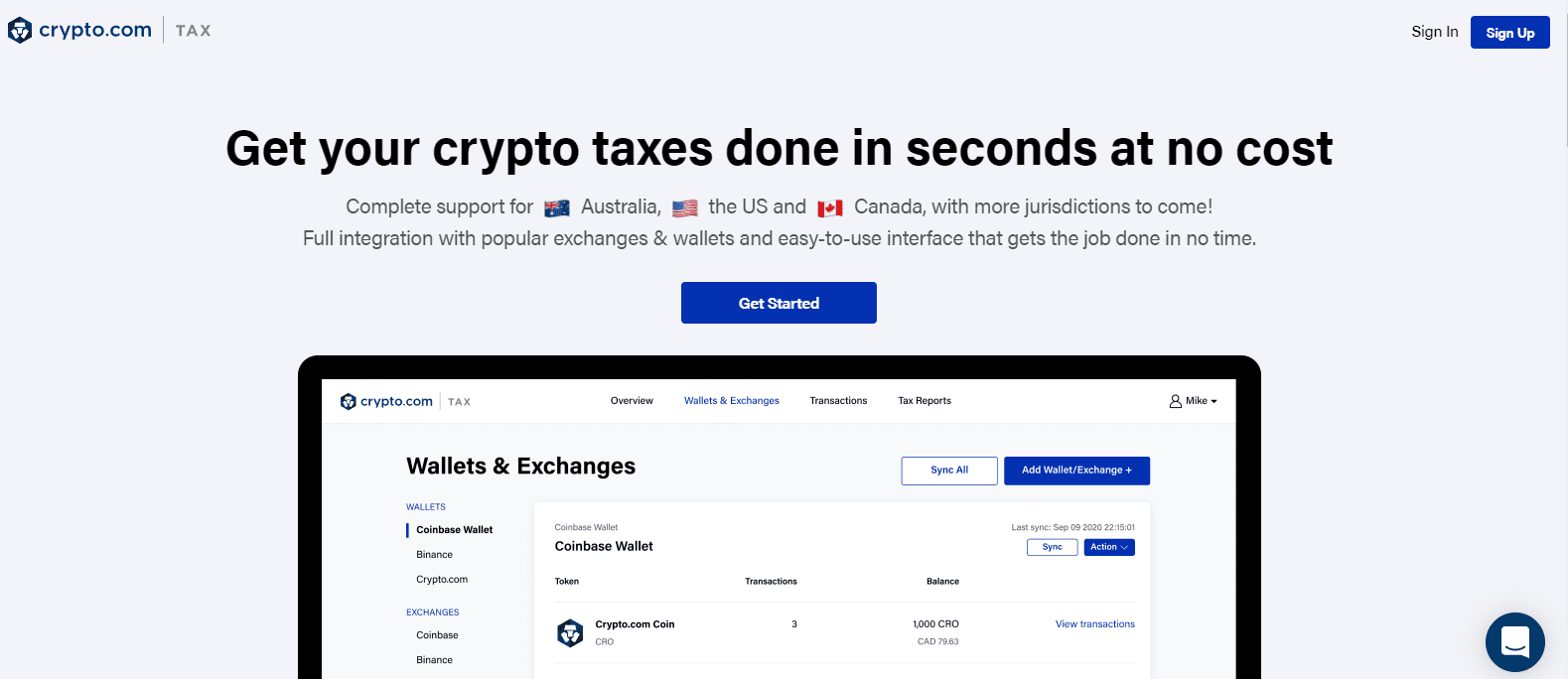

You Should Know That Crypto Com Have Their Own Free Crypto Tax Calculator R Cryptocurrency

Best Cryptocurrency Calculator Mining Profit Taxes

Calculate Your Net Income Manitoba Give Tax Rates Pensions Contributions And More Income Tax Net Income Income

Free Crypto Tax Calculator How To Calculate Cryptocurrency Taxes Zenledger

Bitcoin Tax Calculator Easily Calculate Your Tax Obligation Zenledger

Infographic How Common Is Crypto Cryptocurrency Infographic Knowledge Quotes

Calculate Your Crypto Taxes With Ease Koinly

Canada Calculate And File Bitcoin Cryptocurrency Taxes Coinpanda

Best Crypto Tax Software Top Solutions For 2022